Award-winning PDF software

KS online Form 4626: What You Should Know

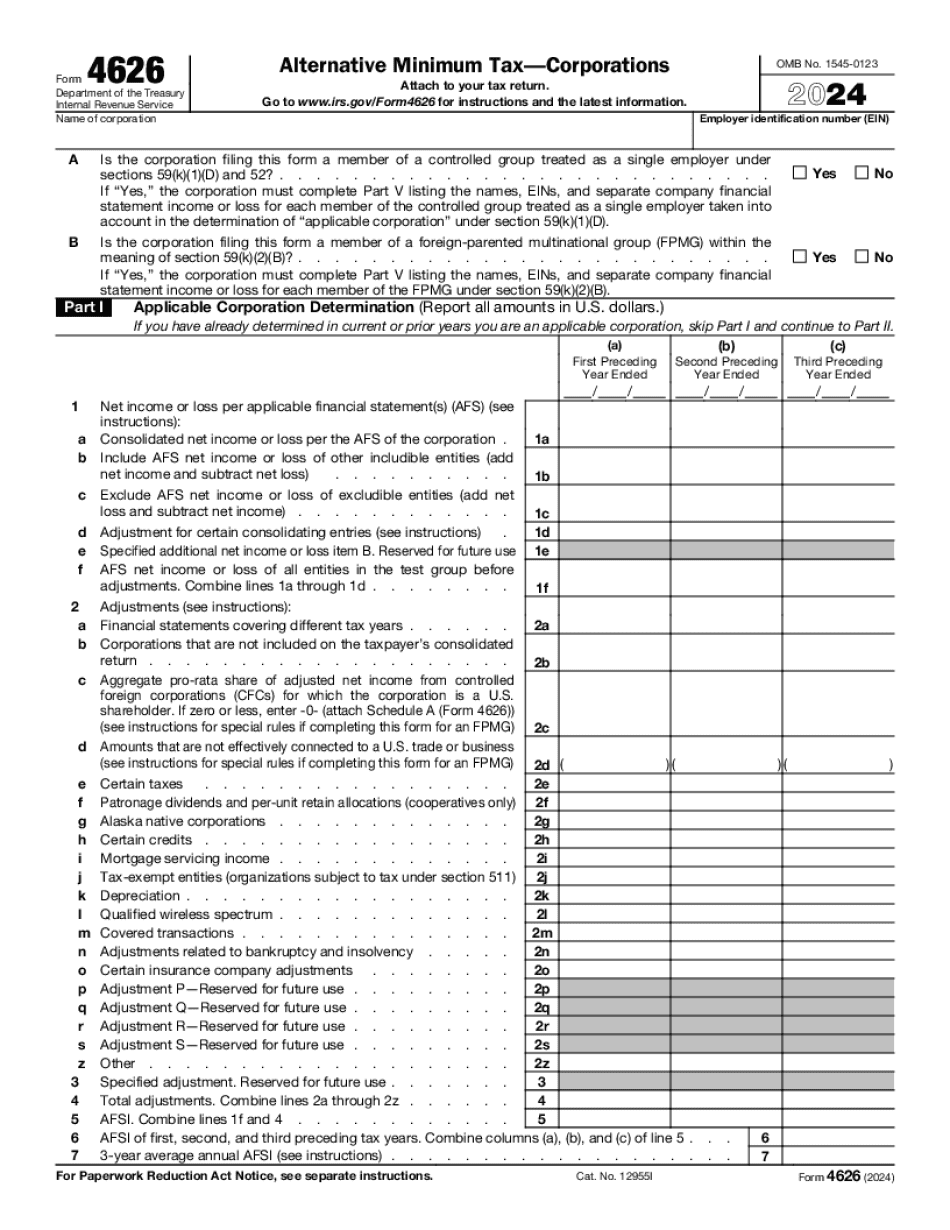

If any part of the return is postponed, report the postponement of that portion. A corporation is not required to file Form 4029 for the new alternative minimum tax (AMT). However, companies with a substantial increase of the amount of its taxable income that is attributable to net operating losses are required to file a Form 4029. If a corporation has net operating losses (Vols), then the new AMT rate and the amount of its Vols, referred to as the “business taxable income threshold,” is the largest amount of taxable income (before any state and local taxes) it is able to pass through to shareholders. The result of adding up the tax liability for these corporations is a new AMT rate. This AMT rate is not equal to the AMT rate for regular corporations. For example, if a corporation earns 100,000 of taxable cash income, it is allowed to expense 3,000 of capital expenditures in a tax year by adding the following amount to its taxable income. The tax bill for 9,000. (100,000 + 3,000) However, the tax bill for 11,000. (100,000 + 4,000) If the corporation is an active, or actively traded corporation, the AMT rate is the same regardless of the amount of its Vols, referred to as the “investment taxable income threshold.” As an example, suppose a 200 million corporations has net operating losses for two consecutive tax years of 10,000. (100,000 + 10,000). The tax bill for 9,000 is the same whether its Vols were used during the previous tax years. In addition, certain corporations pay a special tax rate only if certain items of their activity exceed certain thresholds. If the threshold is exceeded for a corporation for a five-year period in a given tax year, the corporation is subject to the Alternative Minimum Tax rate as well as all the penalty, rather than just the regular alternative minimum tax rate. There is a special threshold for AMT purposes for a business that does not engage in active trade or business. If no active trade or business exists on the last day of each calendar year or if the corporation has no active trade or business during the preceding 12 months, the AMT threshold is 400,000. In addition, a corporation must hold at least 500,000 of U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete KS online Form 4626, keep away from glitches and furnish it inside a timely method:

How to complete a KS online Form 4626?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your KS online Form 4626 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your KS online Form 4626 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.