Award-winning PDF software

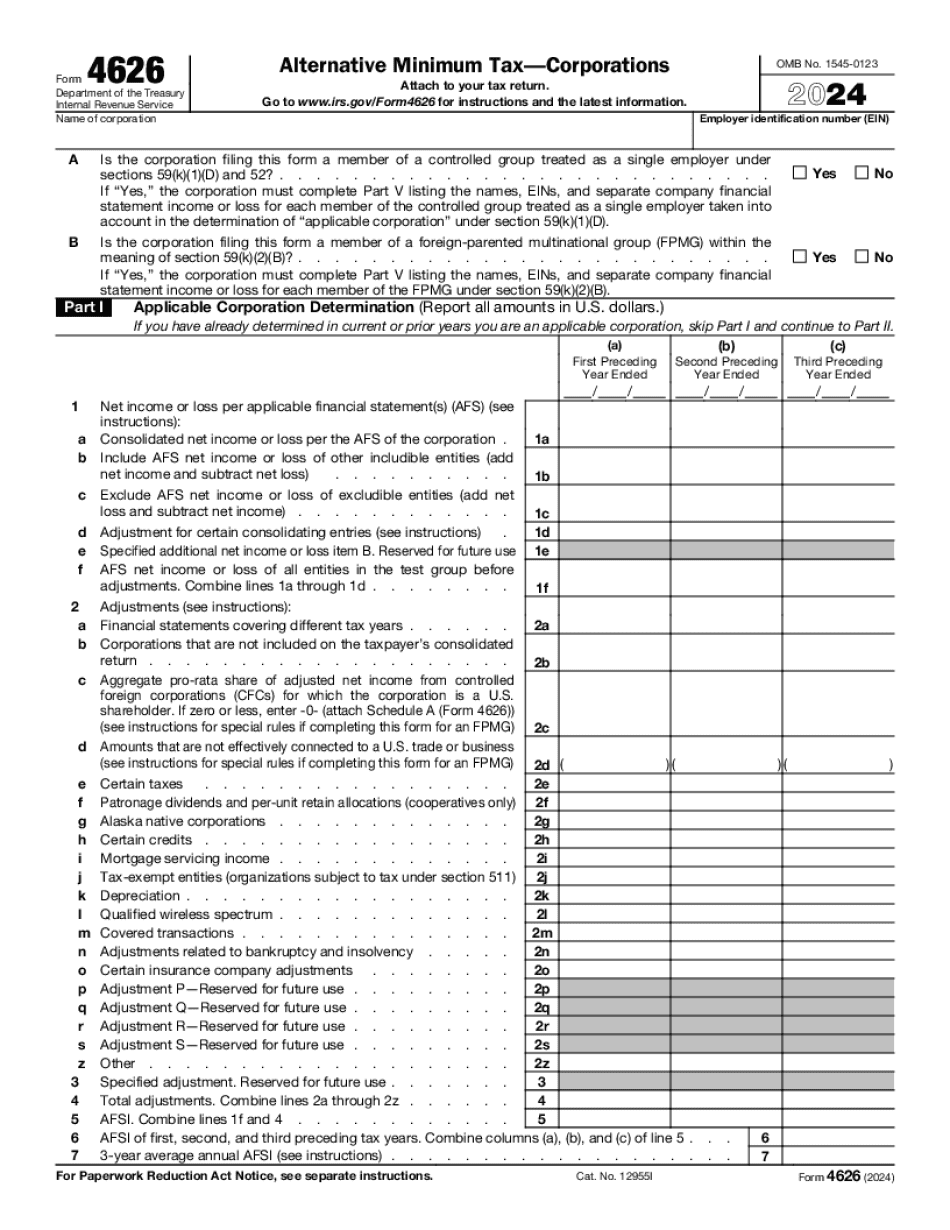

Form 4626 Minnesota: What You Should Know

Schedule ANTI includes all income taxes that relate to the sale of food. If income tax is taken out of one line, there may be some tax not recorded on the other Form 4626. The following instructions apply on Schedule ANTI 2017. The instructions indicate how to calculate a sale price for food of a specific category. You must also report an amount for other expenses and miscellaneous costs and payments. Determine the number of units or pounds of food in the food category you are researching. Enter the total sales price of all foods for which you are doing a sale price calculation for any combination of line 2017 ANTI, Alternative Minimum Tax Sep 26, 2025 — Schedule ANTI — Sales Price Calculations For Food Items: 1. Enter the net retail price (per unit, per pound) of the food or foods that represent each food Forms/Guidance from MN Dept. Aids, 2025 Form ANT-4 Form ANT-4 for food that does not sell at retail (food sold from retail stands, farm stands, farm shops, or grocery stores) requires a complete set of Form ANT-4s to be completed and submitted along with the following documents. 2018 Federal Income Tax Return, Form 4668, Food and Drug Tax Credit, Food Labels, or a copy of Form 4668 as proof of food. 2018 FISCAL YEAR (FY) You completed a food sales sale price calculation using Schedule ANTI for the 2025 tax year, October 2025 to September 2019. Please use the 2025 Schedule ANTI for this one. For the 2025 FISCAL YEAR, we will use Form 4668. A sales price for food shall be considered to be equal to the gross sales price of the food at the retail sale price or the gross sales price of the amount of the food sale without taxes (GUY), if any, if such amount is actually paid by an individual as retail food sales tax upon the consummation of a sale which is completed on a retail sale stand or in a grocery store. This price shall include any tax which is attributable to the costs for the food and may include sales tax as well. Sales price does not include any amounts paid by a retailer for food and sales tax which are paid by the food manufacturer or producer directly to the local taxing jurisdiction.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4626 Minnesota, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4626 Minnesota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4626 Minnesota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4626 Minnesota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.