Award-winning PDF software

Form 4626 for Santa Clara California: What You Should Know

A parcel tax exemption can be granted during the county tax audit, at any time before an assessment date for new assessments. The county tax assessor uses Form 4332 to determine whether the tax liability was properly reduced and whether any additional property value was derived. Property values for the county's school districts are generally calculated at the time of county tax collection. As such, any value of property that is generated during the county tax audit is not reflected in any school district's assessment. For more information, see the Special School District Exemption. Use Form 4332 to complete and submit. Use Form 1094-C for school districts that elect to file the property apportionment form rather than the assessment and special tax bill form that must include the parcel portion of the tax bill to exempt all the property to which a special tax exemption applies. Forms 1094A, 1094 N, 1094P and 1094Q are also used when the county tax apportionment form is filed. Use a copy of the appropriate form with the assessment and special tax bill to exempt the property to which the parcel portion of the tax bill applies. Special School District Exemption Program. The Department of Finance and Taxation administers the special school district exemption program under the California Education Code If the district has the property and the owner is eligible for a special schools property tax exemption, the school district may issue a certificate of exemption to the owner for tax paid, or for future taxes paid with the exemption certificate. For tax paid. A special tax exemption certificate is issued to an owner when the Department of Finance and Taxation receives notice from the school district that the owner is eligible for a special schools property tax exemption. For tax paid, a special tax exemption certificate is issued on a calendar-year basis, and is valid for taxes paid throughout the year. On the declaration of eligibility for a special school property tax exemption, the county assessor may also assign the tax to the owner of the parcel, regardless of the owner's eligibility. In some cases, the county assessor may assign the tax to the owner of an adjacent parcel of land. When the parcel tax exemption certificate has been issued, the county assessor must assign the tax to the owner.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4626 for Santa Clara California, keep away from glitches and furnish it inside a timely method:

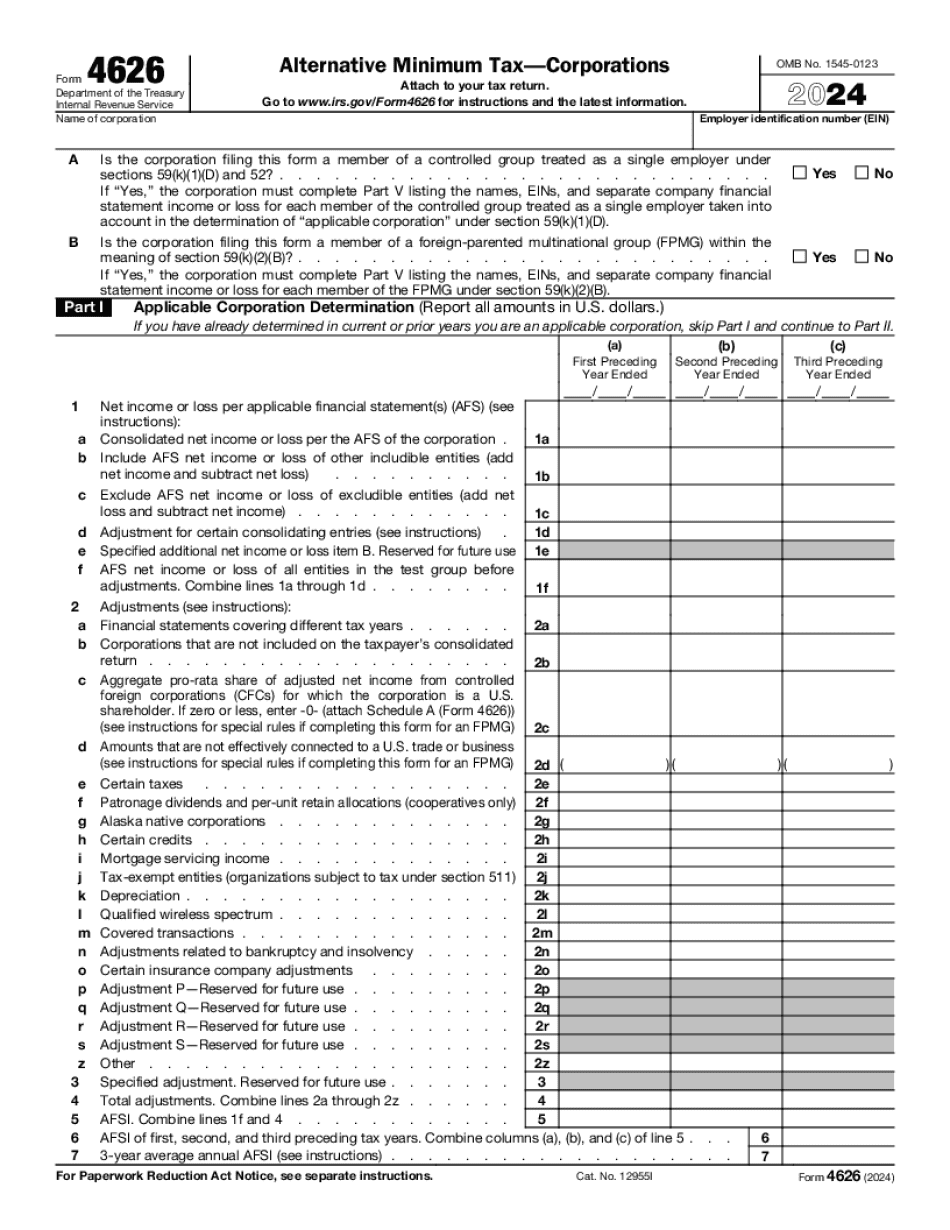

How to complete a Form 4626 for Santa Clara California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4626 for Santa Clara California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4626 for Santa Clara California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.