Award-winning PDF software

Form 4626 for South Carolina: What You Should Know

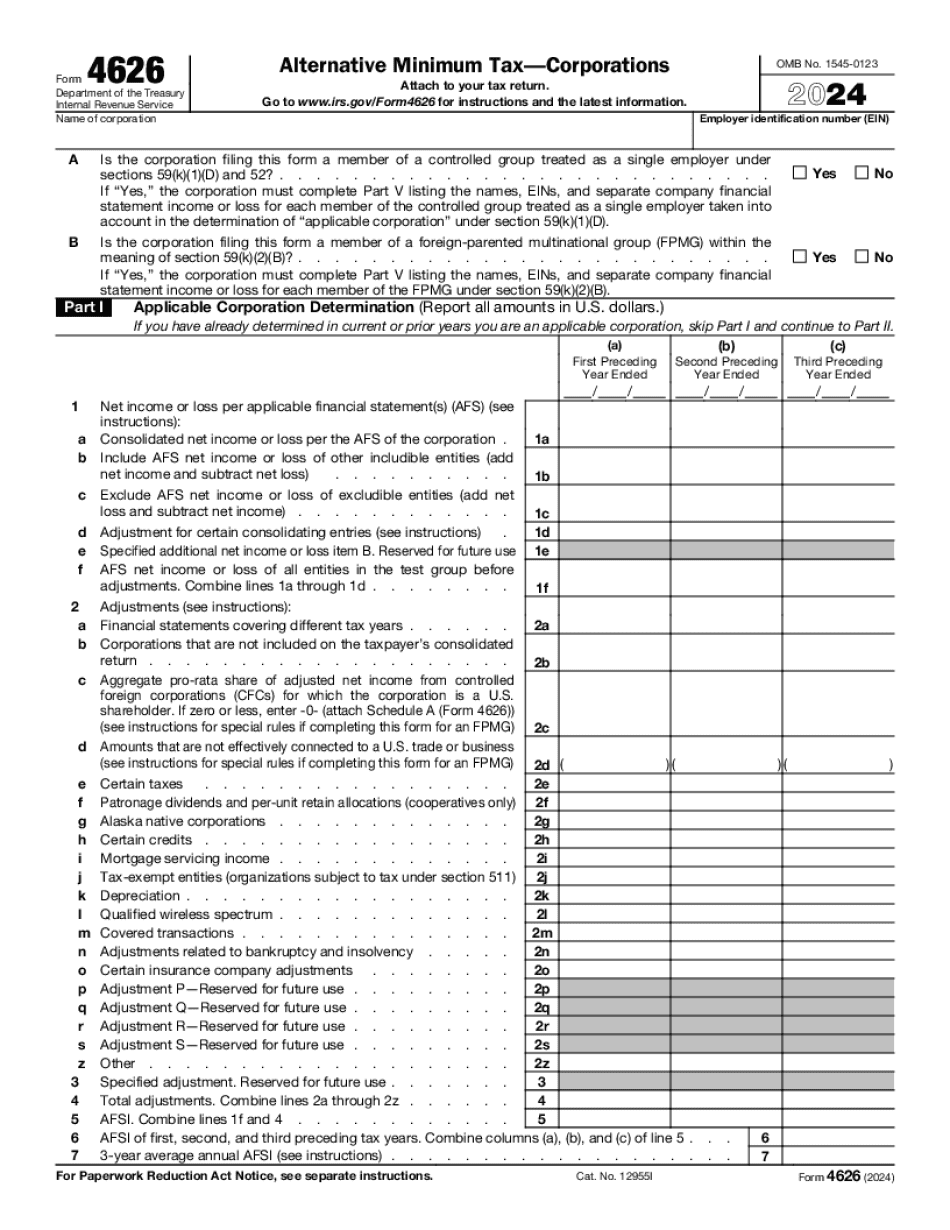

A single copy must be made to the corporation's return or to the partnership return if the partnership filing is exempt. If not filed with the return of the partnership. If you do not file both forms electronically, your Corporation Tax Deductions for Nonresidents The following is the 2025 version of the standard deduction, the standard deduction for joint filers is also increased in 2025 from 6,500 to 13,000, and it is 8,650 for married joint filers and 13,150 for individuals filing as head of household. If you are having questions, please call the CPA firm of Ran, Deutsche, Ravel, and Rosewater, LLC at or call (toll-free). The firm also has a blog that is extremely useful if you are looking for additional tax information. 2018 CORPORATION TAX Deductions for Nonresidents Corporations may be subject to the alternative minimum tax (AMT). Alternative Minimum Tax (AMT) is usually imposed on taxpayers who are not residents of states that exempt them from tax. In South Carolina for example, individuals and partnerships are expected to pay the AMT. For companies, the IRS is not required to impose any AMT in South Carolina. What is the AMT? The Alternative Minimum Tax is a tax imposed on individuals who make investment decisions based on factors other than the objective of making a profit. Such factors can include factors such as the tax treatment of an investment, its level of dependence on a special interest (such as the government) or political party, or its expected future performance. The AMT is designed to prevent tax avoidance, fraud, evasion, and abuse. For more information about how South Carolina's tax rules affect corporations, including the AMT and the changes made to South Carolina's personal income tax, please download our Free Guide to South Carolina Corporations. You can also view the official SA Corporate Income Tax Rates PDF and the Official SA Corporate Tax Rates Website. If you are unsure for which category you fall, please contact the CPA firm of Ran Deutsche Ravel and Rosewater, LLC at.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4626 for South Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4626 for South Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4626 for South Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4626 for South Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.