Award-winning PDF software

Form 4626 for Murrieta California: What You Should Know

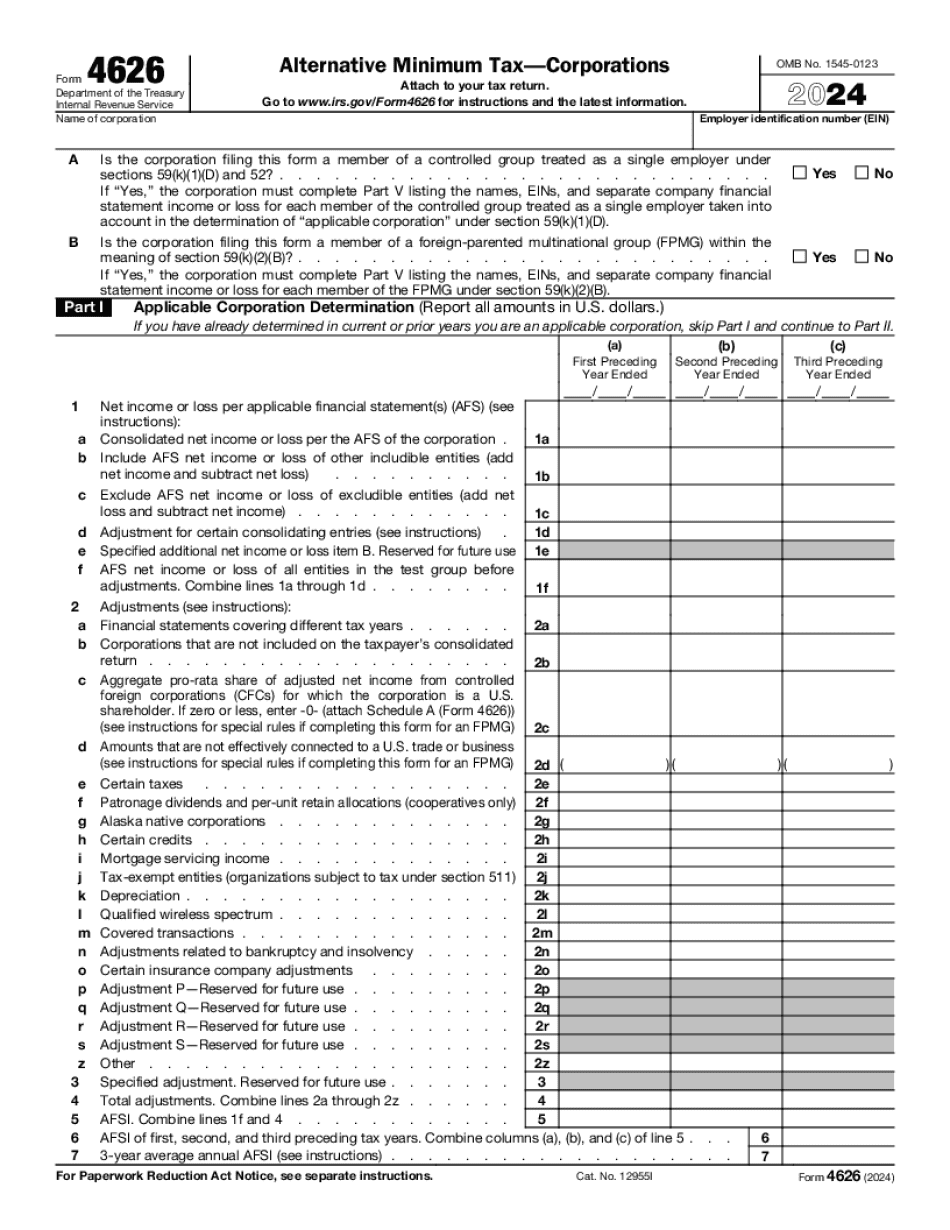

This form may be completed in many forms; however, all forms must be filled to the exact, and you may not use any electronic filing software. A corporation must complete all forms required of it by the corporation's state, if the entity is located there, or the IRS has certified that it is a tax-exempt corporation if it is not located in the United States. Form 4626 is used to determine capital gains tax on corporations for their interest and dividend income from corporate stock held on or before January 1, 2005. Forms 4626B and 4626C (a.k.a. Form 4626-E) may be used to determine net operating loss if the corporation's gain is 1 million or less. Forms 4626D and 4626F (a.k.a. Form 4626G) may be used to determine certain specified long-term capital gains where there is 5 million or more of gain. To calculate the alternative minimum tax, a corporation may use either: Form 5627 Form 5627E Form 1246 or 4610 Form 1351 (formerly 1296) Form 3978 Form 4210 Form 6250 (formerly 6263), Form 7210, Form 7515, Form 8701, Form 8817 Form 985, or Form 4869. ▷ Form 4626 (2017) is used to determine whether the corporation is operating with substantial profit for the tax year. The following rules apply: If an individual, C corporation, S corporation, business trust or partnership earns at least 1.5 million from a single taxpayer for the year, either the individual (3 million) or the corporation (7 million) must file Form 5627. If the single taxpayer is a C corporation, the amount of gain and other adjustments from the disposition of its stock must be included together with the taxpayer's other income or gain reported on the shareholder's report. If each individual in a partnership or business trust has qualifying income for a taxpayer in excess of the threshold amount (75,000 in 2017), the individual income portion of the partnership or business trust must include the amount of qualifying income of each member of the partnership or business trust. Generally, members of a partnership or business trust cannot own stock in the partnership or business trust in a separate class from other income the members earn for the partnership or business trust. For more information, see Publication 541, Business Entities.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4626 for Murrieta California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4626 for Murrieta California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4626 for Murrieta California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4626 for Murrieta California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.