Jaim fellows, I want to talk to you about the alternative minimum tax. Trump basically blew a hole in the alternative minimum tax, which is good news for you. The alternative minimum tax was passed over thirty years ago to ensure that the rich paid their fair share. However, in 2017, even if you were not very rich, you had to start paying the alternative minimum tax. For example, if you were a married couple making $85,000, you were considered rich and had to calculate your taxes under the alternative minimum tax rules. They set a certain threshold, around $85,000, at which point your taxes were calculated differently to ensure you paid more. Your tax preparer probably didn't even mention this to you, as it was expected that you would pay the alternative minimum tax. Trump realized that $85,000 for married couples wasn't really considered rich, so he increased the threshold to $109,000. This means that now you only start paying the alternative minimum tax when you reach $109,000. There was another trick that was used before the Trump tax laws came into effect. If you earned a certain amount over $160,000, for example, $180,000, which is $20,000 over $160,000, they would take 25% of that extra amount. So, $20,000 multiplied by 25% is $5,000. This meant that the alternative minimum tax kicked in at $80,000 instead of $85,000. If you earned up to half a million dollars, you would have to pay the alternative minimum tax on every dime you made. However, Trump changed this as well and increased the threshold to a million dollars. This means that the alternative minimum tax doesn't phase out until you reach a million dollars. Once you reach a million and five hundred thousand dollars, you will still be paying the alternative minimum tax on everything...

Award-winning PDF software

Amt depreciation 2025 Form: What You Should Know

Interesting facts about IRS Form 6033, Alternative Minimum Tax — FAFSA Sep 16, 2025 — Use IRS Form 6033, Alternative Minimum Tax, to figure the alternative minimum tax using the FAFSA (Free Application For Federal Student Aid). You don't have to keep your FAFSA information confidential. 2018 Instructions for Form 6251 — Individuals — IRS Sep 17, 2025 — As a married couple, you can now claim 50,000 to 300,000 of qualified tuition and related expenses you claimed on Form 709 (tuition and fees for high school students and qualified college tuition benefits) 2017 Instructions for Form 709 — Intuit Feb 17, 2025 — You should apply for a Refund of Credit for Health Insurance Premiums (COBRA) by Nov 15, 2016. To apply, get your return, complete and return to: Refund of Credit for Health Insurance Premiums (COBRA) at IRS.gov The CRA has been making it easier and easier to file your federal tax return. They allow you to file online for free through the 2017 IRS e-file portal from Sept 19, 2025 at 11:59 pm Pacific Time. 2018 Instructions for Form 6251 — Individuals — IRS Feb 14, 2025 — You may also need to file Form 8797 for nonrefundable credits and deductions. For some of these forms in 2018, Form 709 or Form 8797 will not work as your tax filer needs to be a resident of the country for which you are Filing requirements for 2025 Individual Income Tax Filing Mar 18, 2025 — As a single tax filer, only make the following tax-filing decisions on tax returns, and not claims: Tax Forms with a dollar value less than 1.00. Income that is excluded from income in the return Forms in an electronic format or not on paper Tax returns and Form 1040 are required to have an entry section where taxpayers will enter their filing status, the information needed for preparation of the return, and the amount of tax owed.

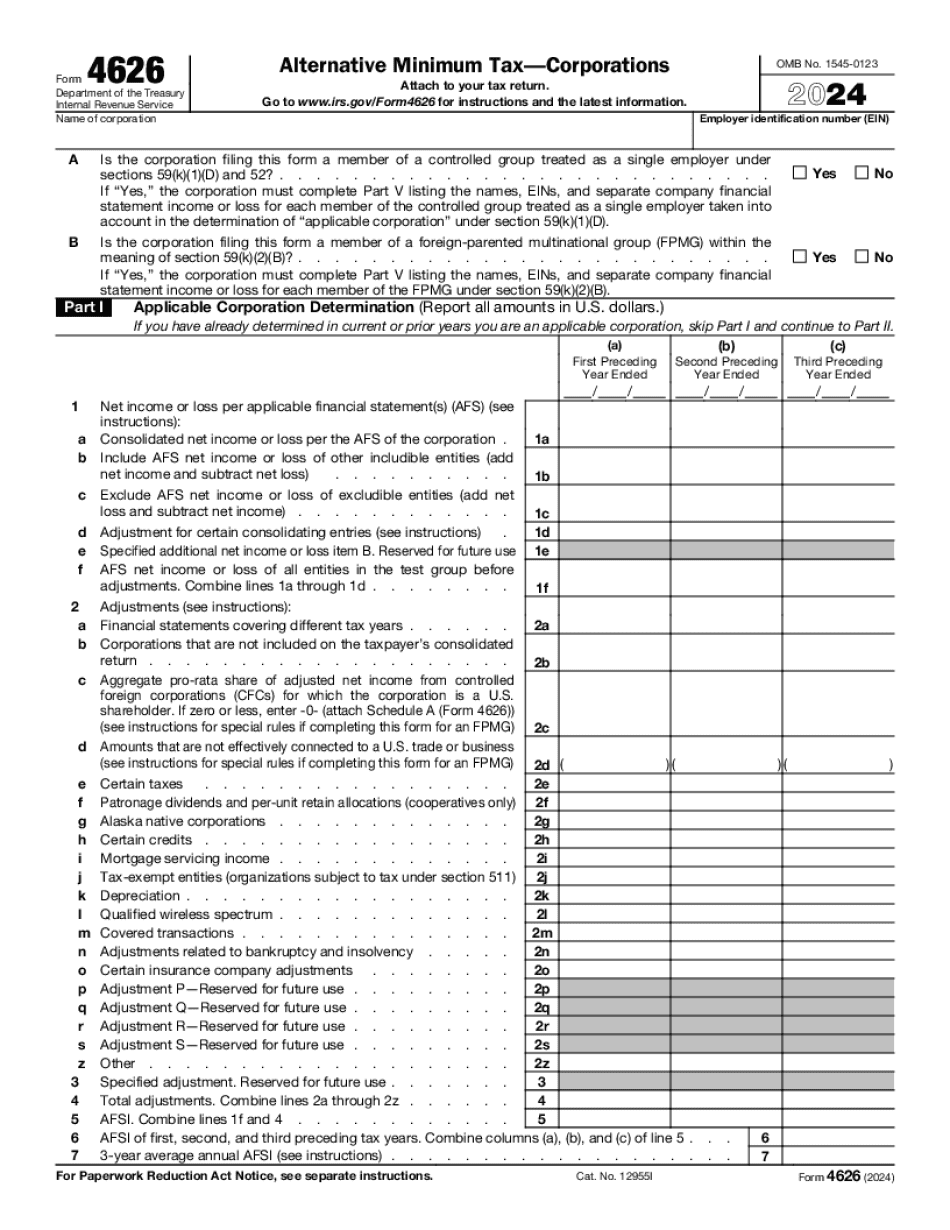

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4626, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4626 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4626 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4626 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Amt depreciation 2025