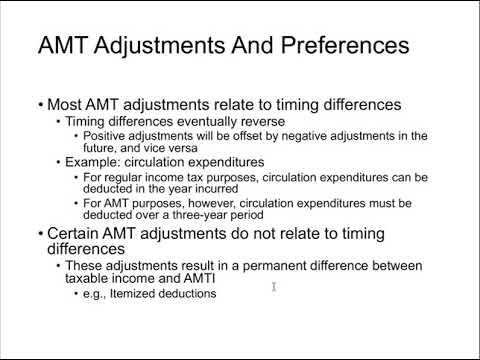

Hello, in this video we'll discuss the alternative minimum tax. Now, this is meant to be a basic discussion regarding the AMT, and in no way is this meant to be an exhaustive understanding of every single concept with respect to the AMT. I also want to make sure to emphasize that the AMT has changed many times over the years, and there have been some big changes with the Tax Cuts and Jobs Act of 2017 and going forward. So, the beginning of this discussion and the general discussion is going to be since the inception until the Tax Cuts and Jobs Act, and in the last few minutes, I'm going to switch over and talk about the Tax Cuts and Jobs Act and how that's affected the AMT. Now, the AMT is really important because it's one of those things in tax that not many people understand. They understand, okay, it's something to do with wealthy taxpayers and maybe they're paying a lower rate than not so wealthy taxpayers, and it's a way to try to level the playing field and make them pay their fair share, that type of idea. But the actual implementation and how it works is another discussion. So, with that, let's jump right into it. What is the AMT? The AMT is, think of it like it's part of the income tax, but it's actually separate. So, we do our income tax calculation for individuals, corporations, estates, and trusts. We have to do the normal income tax calculation. But at the end of our determination, on this side as a parallel structure, we also have to calculate the AMT. The idea is that if the AMT results in a higher amount of tax, that difference between the income tax, the normal income tax, and the...

Award-winning PDF software

Corporate alternative minimum tax 2025 Form: What You Should Know

The seller may elect an alternative withholding amount based on the maximum tax rate (currently 35%) in effect for the most recent tax year. Form 1023, California Business and Occupation Tax Statement; Form 730, California Employer's Withholding Tax Return; Form 1065, California Sales Tax Notice, Sales Tax Exemptions; Taxpayers and Taxpayer's Responsibility Statement; Form 1065SB, California Sales Tax Notice — Nonresidents Taxpayers and Taxpayer's Responsibility Statement; Taxpayers and Taxpayer's Responsibility Statement; Form 6252, California Sales Tax Exemptions; tax year. Taxpayers and Taxpayer's Responsibility Statement; Taxpayers and Taxpayer's Responsibility Statement; Form 7465 (Business Profiles Exemptions) Certificate of Exemption (Form 7465A), (Form 7475) Certification of Exemption (Form 7475A) (Form 7465A) Taxpayers and Taxpayer's Responsibility Statement. If filing a paper return, use Form 706 to determine your exemption amount. If applying for an exemption, do not provide an amount lower than 400 and provide a written explanation of how the exemption is for the individual taxpayer. If applying for exemption, do not provide an amount lower than 400 and provide a written explanation of how the exemption is for the individual taxpayer. If a sale price is included as a tax deduction in the return, it is reported to the IRS with the Form 1040 and Form 1040A, even if the amount of money paid to an employee for items with the same name and description (e.g., shoes) and the same brand name, does not exceed 800 and does not apply to your taxable excess (or you may claim the deduction even if you purchased items that do not have the same name or description as the other items). The 1040(f)(1), California Income Tax Return for Persons Who Do Not Qualify for a Sales & Use Tax Exemption (Form 1040), and 1040, California Income Tax Return for Persons Who Taxpayers Responsibility Statement (Form 1040A) — 10% Exemptions for Individuals Who Have Not Made a Nonresident of California Sale (Form 1040NR) — 10% Exemptions for Individuals Who Do Not Have a California Use Tax Identification Number.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4626, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4626 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4626 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4626 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Corporate alternative minimum tax 2025