So when we have a quorum, Jerry Anderson will file Palace 3162. Members, please take out 31 62 and I see an a.1 amendment. Is that the author's amendment? It is okay, so we will take care of that when we actually have a quorum. Welcome to the committee. Please present your bill. 2. Thank you, Mr. Chair. On the author's amendment, we make an adjustment to allow for recognition of the credits that corporations already have in place. That's what the amendment does. As for the overall bill, the federal tax conformity tax bill eliminated the corporate AMT tax. If Minnesota were to keep the corporate AMT tax, it would make it more challenging and difficult for our businesses to file their taxes, which is opposite of the intent of the federal tax bill. We're trying to make that happen here in Minnesota and that's it in a nutshell. I do have some testifiers, Mr. Chair, if you are ready for that. 3. Thank you very much, Jerry Anderson. We will now go to the first testifier, Beth Badoon, and we'll go on to Bethenny and Jill Larson next. Is there anyone else who wishes to testify on behalf of the bill or with concerns regarding the department on this bill? Okay, thank you, sir. Please state your name and who you represent for the record, please. 4. Thank you, Mr. Chair. My name is Beth Gayden. I represent the Minnesota Chamber of Commerce. I want to thank the Chair, as well as Chair Anderson, for hearing this bill today. We believe it's important to get all the issues impacted by the federal tax conformity issue on the table when we're looking at the tax bill for this year. Corporate AMT repeal was not included in the revenue forecast from the Department...

Award-winning PDF software

Corporate alternative minimum tax repeal Form: What You Should Know

Repeal the Alternative Minimum Tax The AMT exemption is phased out for married taxpayers and qualified widowers with ANTI-exceeding the 150,000 AMT minimum. As a single spouse, you'll qualify regardless of your income level if your ANTI exceeds the 75,000 AMT minimum. This means that if you're single and have zero tax liabilities in the years prior to 2017, you'd not have to worry about having to itemize your deductions to take advantage of the AMT tax credit if you claim it this year. You'd simply deduct the AMT amount from your taxable income in the year you earned it. In other words, you'd need income of less than 75,000 to take all of your Repeal The Alternative Minimum Tax Individuals, married couples filing jointly and surviving spouses are allowed a credit of 1,225 on Form 8949, Alternative Minimum Tax Credit Form, for the Individual Alternative Minimum Tax Credit The alternative minimum tax (AMT) is paid on wages and income from self-employment; any tax liability incurred before the payment of the tax is subtracted from taxable income. The AMT reduces income and increases the government's tax collection, as well as increasing the deficit by about 40 billion each year. Although the tax was first imposed in a 1977 revenue resolution, it was phased in more slowly in its early years. Starting in 2009, the income thresholds for the AMT increased. The standard AMT threshold is a tax bracket. The lower the bracket your income falls into, the larger the AMT tax is. The AMT's basic theory is based on an idea that a percentage of your income goes toward providing “help for the nation's most vulnerable,” and that a higher percentage means a higher tax. A lower tax percentage also means a lower percentage of your income goes toward providing assistance, but you aren't technically required to purchase certain goods or services from the government to be paid less. Many people pay an AMT but get little or no government assistance as a result. People who are self-employed are particularly vulnerable as they pay taxes on their incomes, but often the government doesn't pay them enough to be exempt. The Alternative Minimum Tax can also harm workers and families by increasing the cost of doing business, as well as causing a loss in tax revenues. The AMT is particularly burdensome on small businesses and sole proprietorship.

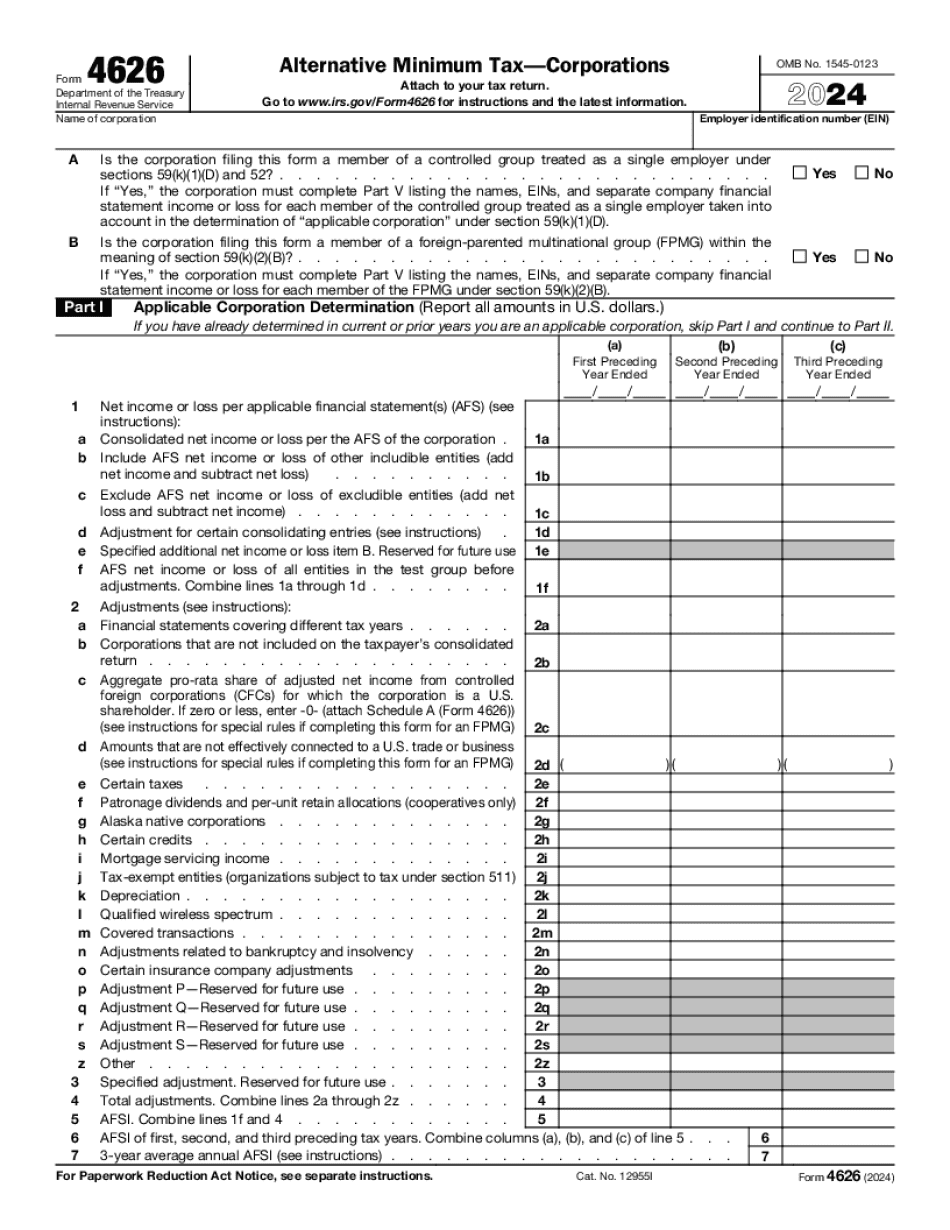

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4626, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4626 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4626 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4626 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Corporate alternative minimum tax repeal