Hi, at this point, I'm turning to corporate alternative minimum tax. The rules for corporate alternative minimum tax shift suddenly away from what we do, which is similar to individual alternative minimum tax. We are going to repeal much of the alternative minimum tax for corporations, but not for individuals. The Tax Cuts and Jobs Act repeals corporate alternative minimum tax, so let's look at the pre-2018 law. For years prior to 2018, the corporate AMT rate is 20 percent of the alternative middle taxable income after a $40,000 exemption. This exemption phases out beginning at $150,000, and many corporations hit that exemption phase-out. Sometimes, it's entirely phased out. So, if you think of it as a 20% alternative minimum flat tax, that's a good approximation of what's going on. Corporations with average gross receipts of less than $7.5 million for the preceding three tax years, small corporations, were already exempt from alternative minimum tax going back to the beginning of the century. Beginning in 2018, AMT is repealed for all corporations, not just the smallest ones. But what becomes of the pre-2018 AMT credit? Let me back up a little bit and give you a brief overview, not a detailed one, of how these AMT credits were generated. When alternative minimum tax was paid in a previous year by a corporation, the amount that the tentative minimum tax exceeded the regular tax for the year, the amount of alternative minimum tax, was added on to the regular tax bill. This difference, that increase over the regular tax, created an alternative minimum tax credit that could be carried forward to future tax years. These credits could bring the regular tax income down, but not below the alternative minimum tax. Each successive future year, if you did not fully use an...

Award-winning PDF software

Corporate amt tax re 2025 Form: What You Should Know

S. Individual Income Tax Return Sep 22, 2025 — Use this checklist to know who you are and how you identify yourself to the SSA and what state your 2018 Instructions for Form W-2G — SSA Form W-2G Sep 22, 2025 — See if you qualify for a deduction for any state tax and state unemployment (U.S. code) contributions. 2016 Form W-2G — IRS Form W-2G Guide (Forms 3366, 3377, 3379, 4501, 4500, or 501(c)(3)), FT.ca.gov 2015 U.S. Tax Form 1040 2 2 2 2 2025 & later 2 2 2 2 2 2025 & later Use the 2025 Federal Income Tax Return to figure your state income tax (or unemployment) withholding, income, and state tax credits. Use the 2025 Federal Income Tax Return for U.S. resident taxpayers (nonresident aliens may be able to use the 2025 filing year, but the form may contain different instructions): California Income Tax Return, FT.ca.gov The state of Michigan's unemployment compensation tax law applies to you. You may also use IRS Form W-2G or a separate Form W-2 from your employer at work to figure out what state unemployment tax is due. Tax Tip: If you don't have unemployment insurance coverage it can cost thousands to figure out what state you owe. If you have any doubt you get a free calculator at eForms.com and use my tax return as your basis Exempt Organization If you don't file Form 990-S, you don't get a refund and your organization may lose its exempt status. Learn more about what to file in Form 990-S from the IRS website. The Taxpayer Advocate Service helps taxpayers who disagree with our taxes. To learn more, visit TAS.

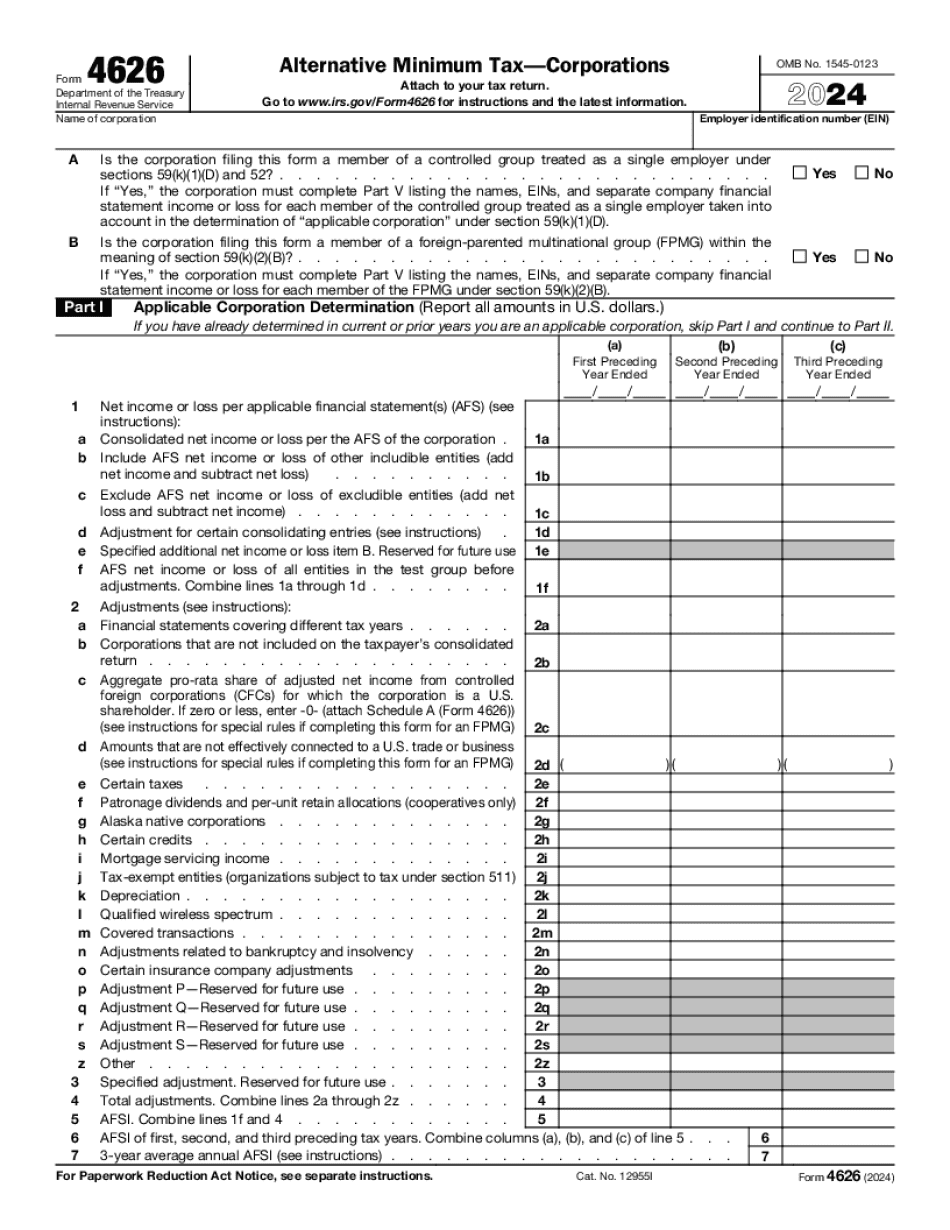

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4626, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4626 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4626 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4626 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Corporate amt tax reform 2025