Good afternoon, everybody. My name is Isolated Numbness, and we're here today to talk about the recent changes in the alternative minimum tax and how it affects your tax return for 2016. To begin, please connect to the voice version through your telephone. But before we get started, I want to make a disclaimer that this is not formal advice. If you believe that you're affected by these rules, it is important to seek specific advice to determine the next steps in your particular situation. Now, let's go through the agenda for this afternoon. We will have a brief introduction and discuss the values of our firm. Then, we will provide background information on the alternative minimum tax before discussing the rules. Next, we will examine what was in place before the Walmart case was resolved. We will also discuss the results of the lower case and how it changed things. Additionally, we will cover the response of the Puerto Rico Treasury to that case with Administrative Determination 1611. We will then analyze the credits that can result from these changes and address any pending items that are still unclear. Just to recap, my name is Isolated Numbness, and I'm a CPA and tax partner with Cuban Grant Thornton. Lena Morales, also a CPA and tax partner at Cuban Grant Thornton, will be answering your questions through email. You can write your questions in the chat on your screen, and Lena will do her best to answer them all. If she is unable to answer any questions, we will respond via email later. While Lena answers your questions, I will continue with the presentation. Here are the values of our firm: Collaboration, Leadership, Excagility, Respect, and Responsibility. Today, we aim to collaborate with you and provide the guidance you need before filing your 2016...

Award-winning PDF software

2024 corporate amt Form: What You Should Know

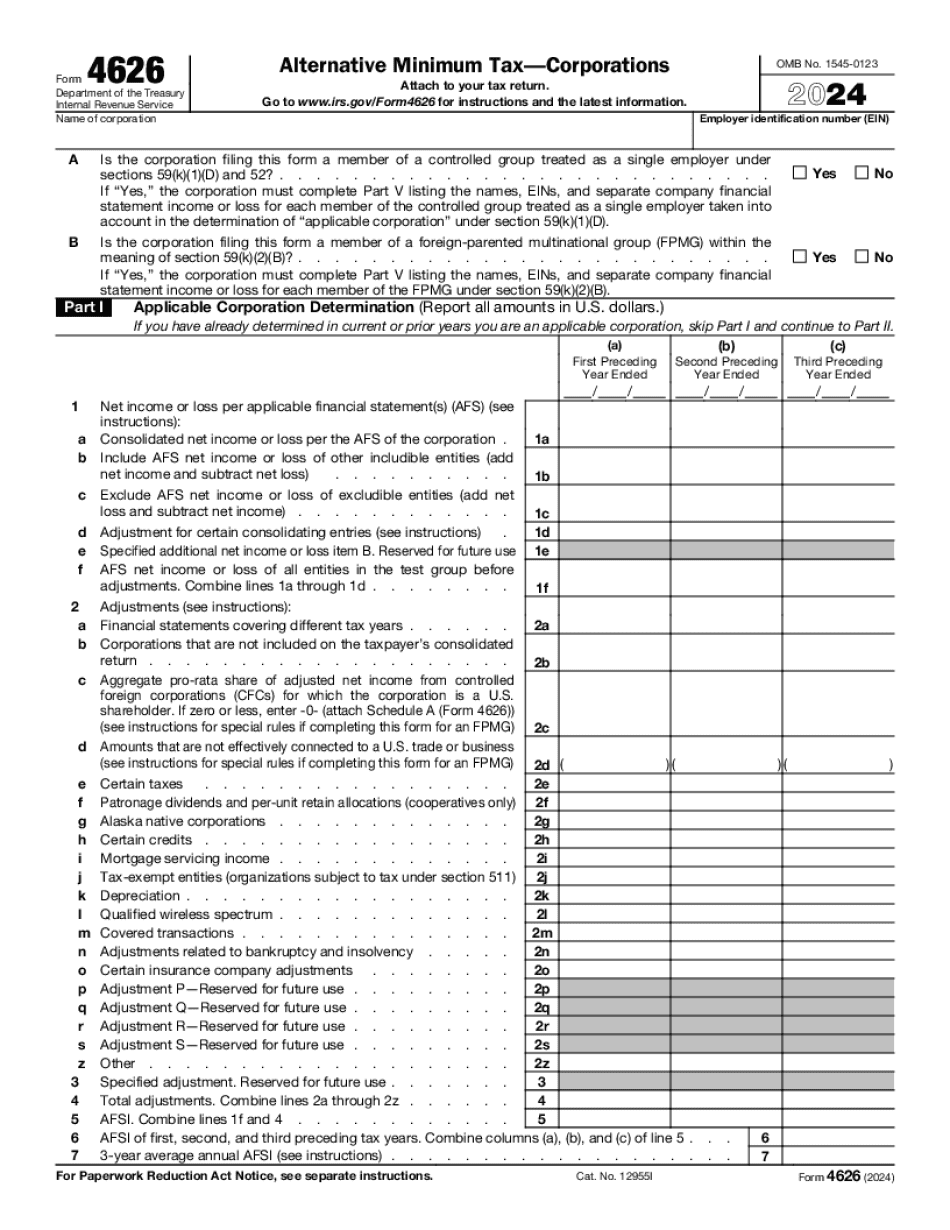

Your tax year is more than one. 2. Your basis in taxable property was less than 400,000. Enter the portion of your basis that is greater than 400,000, your state adjustment, your AGI plus the amount you deducted under the AMT, minus the amount of state adjusted basis. After state adjustments and AGI, include the AMT credit and the TMT and apply the credit as follows: a. If your AGI is 400,000 or more, add the amount from Form 1023, Alternative Minimum Tax, Schedule B, or Form 2106, Alternative Minimum Tax Return, subject to the following conditions: 1. Your tax year is different from that of any other taxpayer. b. If a reduction is required to claim the AMT credit, the reduction must be taken from the amount to which the AMT credit is otherwise limited. c. If you file Form 940, Schedule SE, or Form 945, enter the amount on line 32. 2. Deduction amount. Enter the amount reduced from Form 1023, Alternative Minimum Tax, Schedule B, or Form 2106, Alternative Minimum Tax Return, subject to the following conditions: 2. Your tax year is more than one. 3. You claimed the AMT credit for any taxable year before 1995. Enter the amount from 1023, Alternative Minimum Tax, Form 2321, or Form 2322, or from a statement accompanying any or all of those forms, subject to the following conditions: 3. You claimed a deduction for the AMT exclusion in the tax year in which you realized the taxable interest. Enter the maximum number of tax years in your first 10 years of ownership. 4. Deduction subject to the 40,000 exclusion amounts. Enter the 40,000 exclusion amounts, and enter the appropriate amount from the table in (i) below. Form 1023 is the form to file for your claim. 3. Deduction amount subject to the 120,000 exclusion amounts. Enter the 120,000 exclusion amounts, and enter the appropriate amount from the table in (i) below. Form 1023 is the form to file if you did not claim the AMT exclusion in the tax year in which you realized the taxable interest. 4.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4626, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4626 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4626 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4626 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 corporate amt form