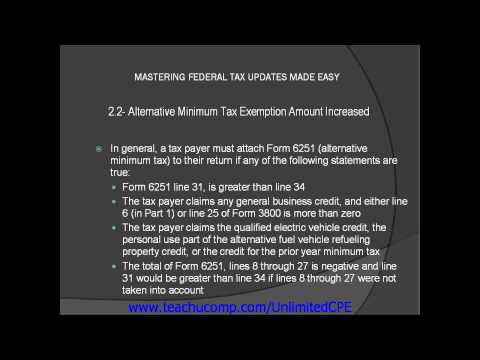

Get unlimited access to all of our CPE courses at wwt you calm calm forward slash unlimited cpe. The alternative minimum tax exemption amount has increased for 2012. This chart shows the new amounts depending on the filing status of the taxpayer. The alternative minimum tax is in place to ensure that taxpayers who benefit from certain exclusions, deductions, or credits pay at least a minimum amount of tax. The AMT is a separately figured tax that eliminates or reduces many exclusions and deductions. In general, a taxpayer must attach Form 6251 to their return if any of the following statements are true: Form 6251 Line 31 is greater than Line 34, the taxpayer claims any general business credit and either Line 6 in Part 1 or Line 25 of Form 3800 is more than zero, the taxpayer claims the qualified electric vehicle credit, the personal use art of the alternative fuel vehicle refueling property credit, or the credit for the prior year minimum tax. Finally, the total of Form 6251 Lines 8 through 27 is negative and Line 31 would be greater than Line 34 if Lines 8 through 27 were not taken into account. This is a picture of Form 6251. Taxpayers should follow the instructions listed in order to figure the alternative minimum tax for 2012. There are also further instructions in the IRS PDF file instructions for Form 6251. Like what you see? Get unlimited access to all of our CPE courses at wwt to calm calm ford/unlimited CPE.

Award-winning PDF software

4626 small corporation exemption Form: What You Should Know

The Due Dates must be at least 60 days prior to the due date of the return. See also Publication 968, Tax Withholding and Estimated Tax for Individuals, Schedule A. Publication 968. See U.S. tax laws for more information on how to prepare Form 4626. IRS Form 4626 has information specific to each state. Other Important Information. To determine if a corporation may be a small corporation, see section 6109(b). If you have questions about the form, consult the Form 4626 instructions. Form S-4 May 10, 2025 — Annual report; Form S-4. If you are a corporation that does not file a copy of Form 5326 (Form 1040), Form 1120, Form 5471, or Form 8949, and you receive Form S-4, report the information from the Form S-4 on your next income tax return. A corporation with two or more shareholders who file Form 5326 will be treated as a single corporation. See section 66(e) of the Internal Revenue Code (IRC) and Rev. Pro. 2016-36, which states that a shareholder is treated as a single shareholder for the purpose of determining whether section 83(b) of the IRC applies for purposes of the election. Publication 586, Reporting the Information That You Pay With respect to Corporation Income and Other Information. See I.R.C. section 1.861-3(c) for other information that you must report with respect to Form S-4. The instructions to Form 4531 (Report for Employer's Businesses), if you are a non-exempt S corporation, also may be necessary. You may need to check with your financial institution for Form S-4 instructions. Also In This Category. Other In this Category. Instructions for Form S-4 Iowa Corporate Tax Returns Iowa Corporate Tax Return Instructions May 19, 2025 — Filing Instructions. If a foreign person makes payment of tax to the federal government on behalf of its Iowa residents, the U.S. Treasury or IRS office in Iowa receives a copy of the payment certificate, or an order (Form 8948) authorizing payment. The U.S. Treasury may collect the payment when it approves your return. File Form S-4 if you owe Iowa income tax and have not paid the full tax. You may be subject to a late fee. There may be an additional penalty for failing to complete a required U.S. federal return, such as Form 4040 or FAR.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4626, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4626 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4626 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4626 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4626 small corporation exemption